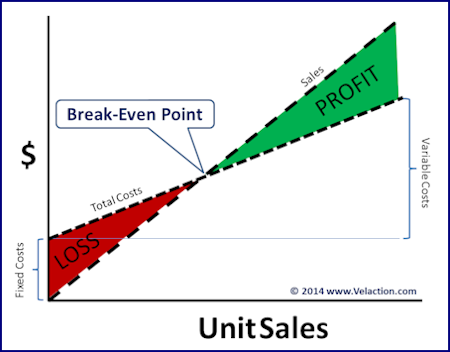

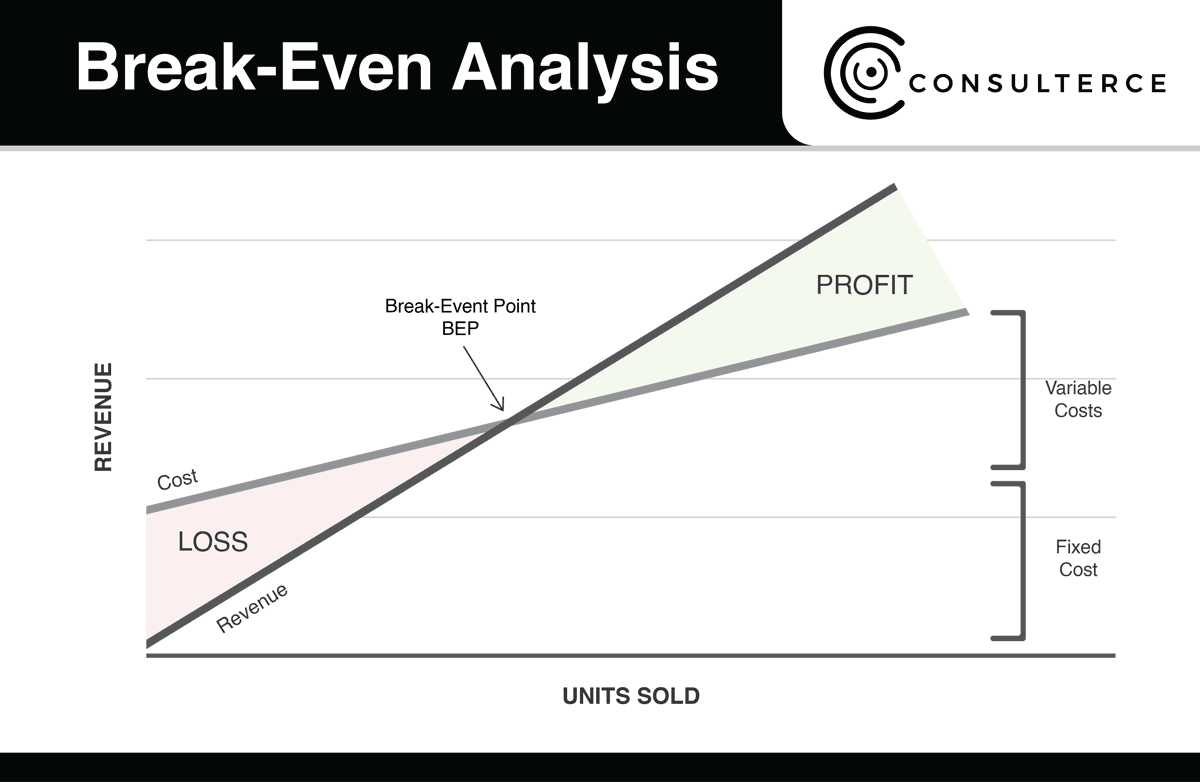

This $60 is then used to cover the fixed costs, and if there is any money left after that, it’s your net profit. So if you’re selling a product for $100 and the cost of materials and labor is $40, then the contribution margin is $60.

The fixed costs are those that do not change no matter how many units are sold.

BREAK EVEN POINT HOW TO

How to calculate a break-even point based on units: Divide fixed costs by the revenue per unit minus the variable cost per unit. Here is how to caclulate break-even point: One is based on the number of units of product sold and the other is based on points in sales dollars. There are a few basic break-even point formulas to help you calculate break-even point for your business.

Then ask yourself these questions: Are your prices too low or your costs too high to reach your break-even point in a reasonable amount of time? Is your business sustainable? How to calculate your break-even point Once you determine that number, you should take a hard look at all your costs - from rent to labor to materials - as well as your pricing structure. Learn more What is the break-even point for a business?Ī business’s break-even point is the stage at which revenues equal costs.

0 kommentar(er)

0 kommentar(er)